©phototechno - Getty Images

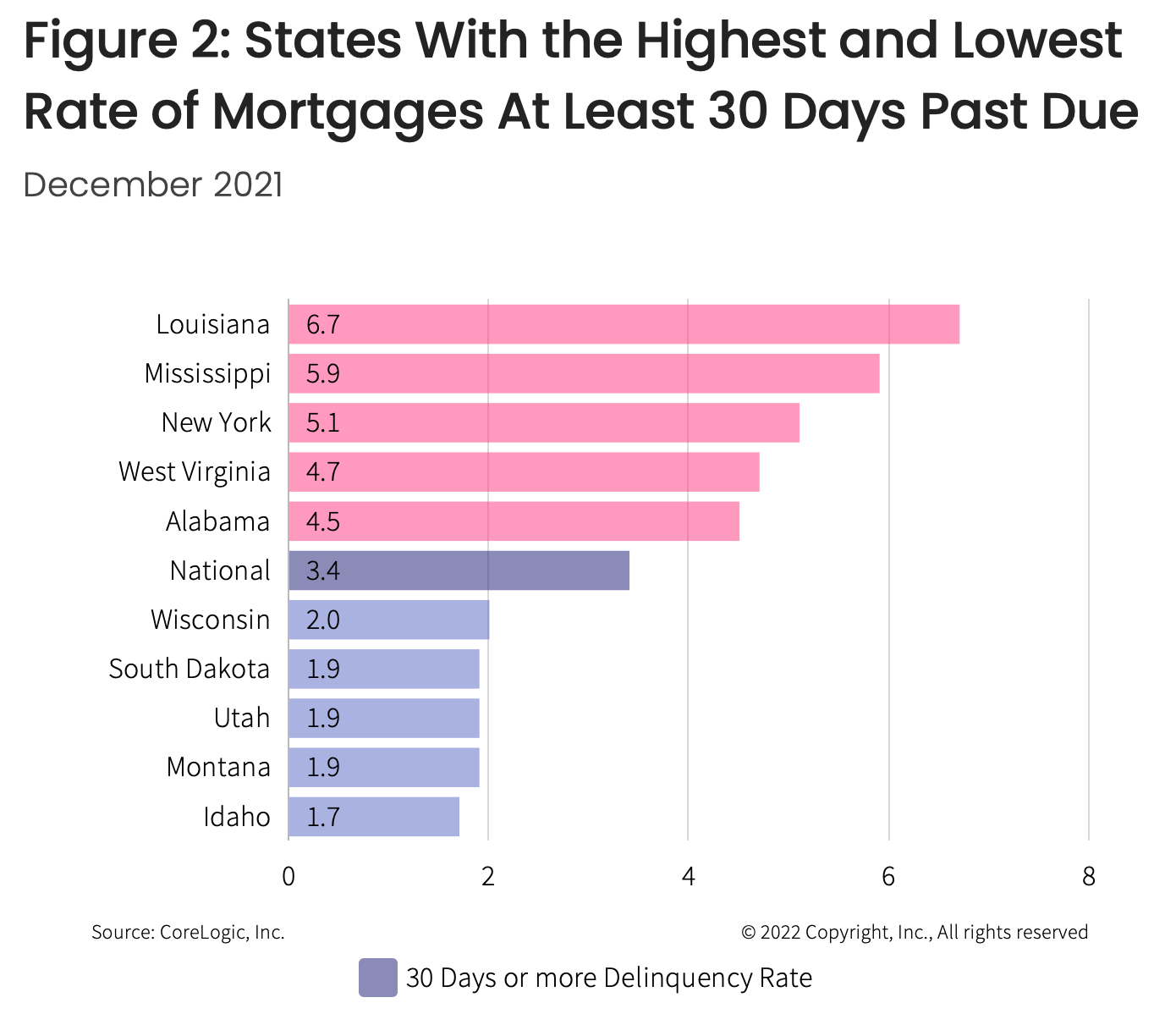

The percentage of homes with mortgages that have late payments or are in foreclosure has dropped to the lowest seen on record in more than two decades, according to CoreLogic’s data dating back to 1999. The nation’s overall delinquency dropped to 3.4% at the end of 2021, with the majority of states posting a year-over-year decrease in delinquencies, according to CoreLogic’s newly released Loan Performance Insights report.

Declining unemployment rates and higher home prices are helping more homeowners stay afloat. “National home prices increased by 18.5 percent year-over-year, helping more owners regain equity,” Molly Boesel, principal and economist at CoreLogic, writes in the report. “The combination of these dynamics pushed the overall mortgage delinquency and foreclosure rates to the lowest levels that CoreLogic has recorded in more than two decades.”

The data also reflects a time when pandemic-related forbearance aid was put in place to help financially struggling homeowners, although for many owners it had expired by the end of the year. U.S. employment has been robust and home equity levels have been on the rise, both of which have helped keep homeowners from going under. Lenders also reportedly have been stricter when issuing loans during the pandemic, ensuring it was to borrowers who were unaffected by hardships.

The majority of states saw a yearly decline in mortgage delinquencies, except for parts of Louisiana, which researchers attributed to damages from Hurricane Ida.

Otherwise, improvement in delinquency numbers suggested stronger loan performance across the board at the end of 2021. “The 30-, 60-day, and foreclosure rates are at the lowest that we’ve seen in a generation,” Frank Nothaft, chief economist at CoreLogic told the National Mortgage News. “What’s still elevated is the serious delinquency rate (90 days or more past due). Even though that’s way down from the peak we saw in 2020, it’s still above pre-pandemic levels.”

As for 2022 expectations, the data may not be as rosy coming off such low numbers. “There will be some distressed sales in the marketplace,” Nothaft says. “So we’ll see an uptick in that in 2022.” But rising home equity could help alleviate some possible distress as financially strapped homeowners may opt to sell instead.

About the Author

Ryan Christensen

Responsive, Responsible and Resourceful - How Real Estate Should Be. This is the foundation of our continued success: responsive service, providing accurate and timely information, and demystifying the process. 100% of my business is referral based because I listen to my clients' needs and exceed their expectations. As a full-time real estate broker, I am the best advocate for both my buyers and sellers. I am always available, regardless of the time of day.

Being a native Southern Californian is a tremendous advantage. I know the area. Time is more valuable than money, but neither can be wasted. And, I'm a fan of hard work. My clients can enjoy their home buying and/or selling experience because I provide a trusting, focused, straightforward approach. I look forward to helping you achieve your goals and find joy in homeownership.

I am both a licensed Real Estate and Mortgage Broker. Others choose to concentrate on one or the other. I provide a higher level of service and expertise than those who do not obtain this dual skill set, which differentiates me from other service providers. My decisions and advice are based solely on what is in the best interest of my clients. I use Real Estate Sales as a tool to make sure my clients get the home that meets or exceeds their needs. As a Mortgage Broker, I search for the best loans so I can offer lower rates and pricing than my financing competition. This certainly IS in the client's best interest.